FAME

Proprietary AI Machine Learning

Factor

Analytics

Machine Learning

Engine

Personalized

Bespoke, customized, tailored for you

Dynamic

Dynamically managed using machine learning algorithms

Real-time

Real-time data-driven, 24/7

Factor Analytics

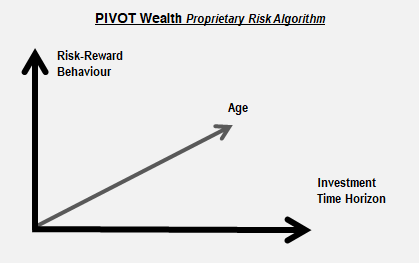

Our Machine Learning AI algorithms behave like competing analysts vying for decision. FAME picks the “winning” algorithms that have the highest probability of being “right” - in terms of maximising predicted Return/Volatility (Risk-adjusted return) or minimising portfolio downside (Maximum Drawdown).

Sheer computing power crunches real-time data to discover, recognise & test various data patterns in terms of positive or negative correlations under different “State of the Market” scenarios for the chosen time horizon.

FAME identifies the best combination of investment assets whose predicted Risk & Return parameters best match the client’s target volatility (or risk profile).

Dynamic Asset Allocation Engine

Machine Learning

Algorithms

Product

Selection

Transaction

Optimization