Master Greed & Fear to Invest Smarter

The world is on edge as the Russian invasion of Ukraine wreaks havoc on the global economy

To be clear, the world and investment markets have watched the months of brazen Russian military build-up on Ukraine borders. Gawking at the USA’s efforts to expose plans by President Putin to invade Ukraine, the people of Ukraine and investors mostly carried on hoping and thinking it would not happen. But happen it did on 24 Feb 2022.

What we are witnessing is a mind-boggling mix of modern-day geopolitics intertwined with history laced with long running power agendas from all sides. In fact, Ukraine and many other former Soviet bloc countries look like unsuspecting pawns in the grand chess game.

There are complex interests at play. At the risk of oversimplifying the myriad of issues, some well-known grievances include Russia’s alarm at the eastward expansion of NATO absorbing former Soviet bloc states and the US concern that the upcoming Nord Stream 2 gas pipeline linking Russia to Germany will weaken the traditional US-Europe alliance.

Above these complexities, we are saddened by the unnecessary suffering and deaths. Our hearts, prayers and thoughts go out to the people of Ukraine and others caught in the crossfire.

Implications for the global economy and investment markets…

There are dire global consequences if the Russia-Ukraine conflict spirals into a direct confrontation between Russia and NATO.

Economically, Ukraine is a major grain exporter and much of Russian gas is piped through Ukraine to get to Western Europe. There are inflationary implications if the Ukraine conflict adds to the current global supply bottlenecks, especially in food and energy.

On 2 Mar 2022, in a rare emergency session called by the UN Security Council, 141 out of 193 member nations of the UN General Assembly voted overwhelmingly to reprimand Russia for invading Ukraine and demanded the withdrawal of Russian military forces.

Several major economies have imposed unilateral sanctions on Russia, including blocking Russia from the SWIFT international banking mechanism. But such sanctions also hurt those imposing it. And Russia will retaliate. We are only in the early phases of the hot war, and the economic war is just beginning.

There is so much we can cover, but we will talk the Ruble and the impact on banks. Then we round off with lessons for our investment strategy.

USD vs the Ruble

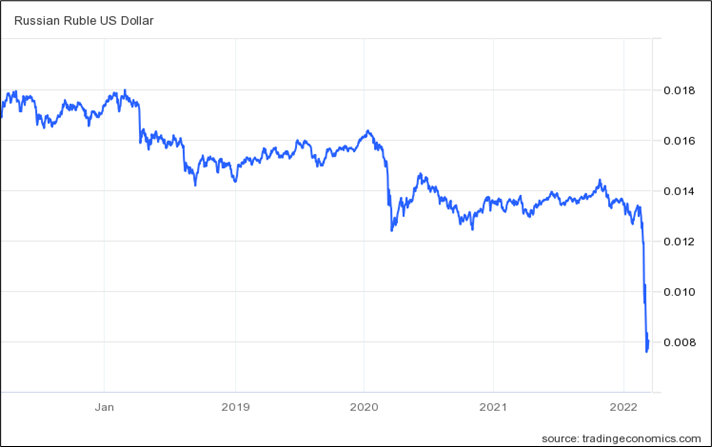

If you look at the 5-year chart, you can clearly see the impact of global sanctions against Russia. The Ruble has fallen off a cliff! It’s hard to think that it’s business as usual for Russia. It’s also hard to think that Russia will not hit back. There’s likely to be more volatility for markets in the short term.

However, our main purpose for talking about the USD vs the Ruble is to share what we call the time horizon. To be a smarter investor, we need to understand the impact of time on what we see – and what we think we know.

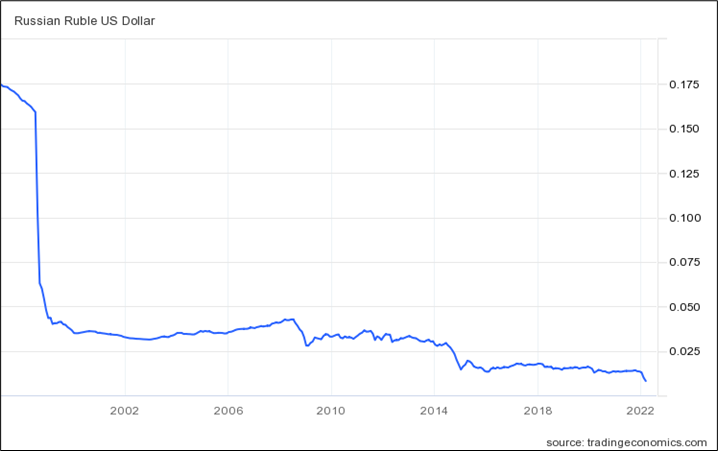

For instance, in the chart below, the Ruble’s fall off the cliff in the first week of March 2022 seems like it did not happen when you look at the same USD vs Ruble chart – but this time – over a longer period of 25 years!

So it seems Russia has gone through a bigger Ruble depreciation than our young generation sees today.

Lenders to Russia

In fact, in smart investing, it pays to look over your shoulder. Rather than look at Russia where all the attention is, look at the European banks who are exposed to Russian debt.

On 9 Mar 2022, the Fitch Ratings followed S&P Global and Moody’s to downgrade Russian government bonds to junk status and warned of an imminent Russian “sovereign default”. Estimates suggest Russia owes roughly USD 40 billion worth of euro- and dollar-denominated sovereign debt, of which USD 20 billion is held by foreigners.

Our analysis suggests that this is a relatively small sum. For instance, just the 2020 interest payment on the USA’s debt held by foreigners was USD 137 billion. Therefore, a Russian default is unlikely to pose a major systemic risk to the global financial system. It will be painful nonetheless for those banks which are particularly exposed to Russia.

With the free fall in the Ruble, European or other banks who are heavy lenders to Russia and its companies will be shivering as there is almost no way they can get their money back. For the older ones, just recall the Asian Financial Crisis of 1997 when currency devaluations exacerbated by FX short sellers and excessive debt financed spending by Asian economies led to collapse of many governments and years of austerity for their people. The Asian borrowers simply could not repay the loans denominated in USD with their own diminished local currency. Asian banks collapsed as a result, and many had to be bailed out.

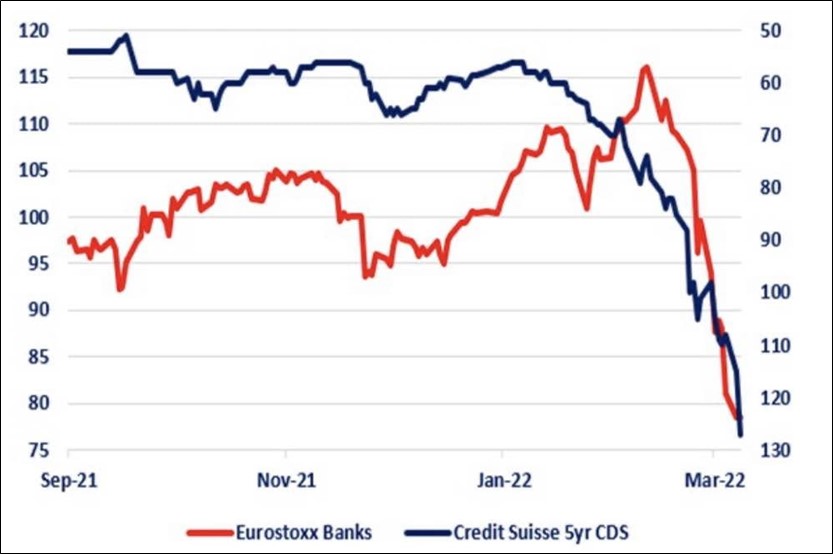

Credit Suisse 5yr Credit Default Swaps (CDS) & European Bank Stock Prices

The Credit Suisse CDS have fallen sharply indicating the market’s anticipation of distress for the bank. European bank stock prices have been hammered indicating worries over the loan exposure to Russia.

A credit default swap is essentially insurance against the company defaulting on its debts. The price fall shows that few are ready to offer that insurance. If a default occurs, it will have significant ramifications on the broader market.

Lessons for Smart Investors

The Russian invasion of Ukraine is a geopolitical conflict. It is not an economic crisis such as the 1997 Asian Financial Crisis or the 2008 Global Financial Crisis - at least not yet. If a ceasefire can be negotiated, the markets will bounce back. The big worry is the potential to spill over into a wider confrontation between NATO and Russia – which will raise the nuclear red flag.

What does a crisis mean to Smart Investors?

There have been repeated cycles of crisis and heightened market volatility in the last 100 years. The same lesson over and over is that if we invest with emotions, we are likely to buy high and sell low.

Let’s clear our minds with some facts.

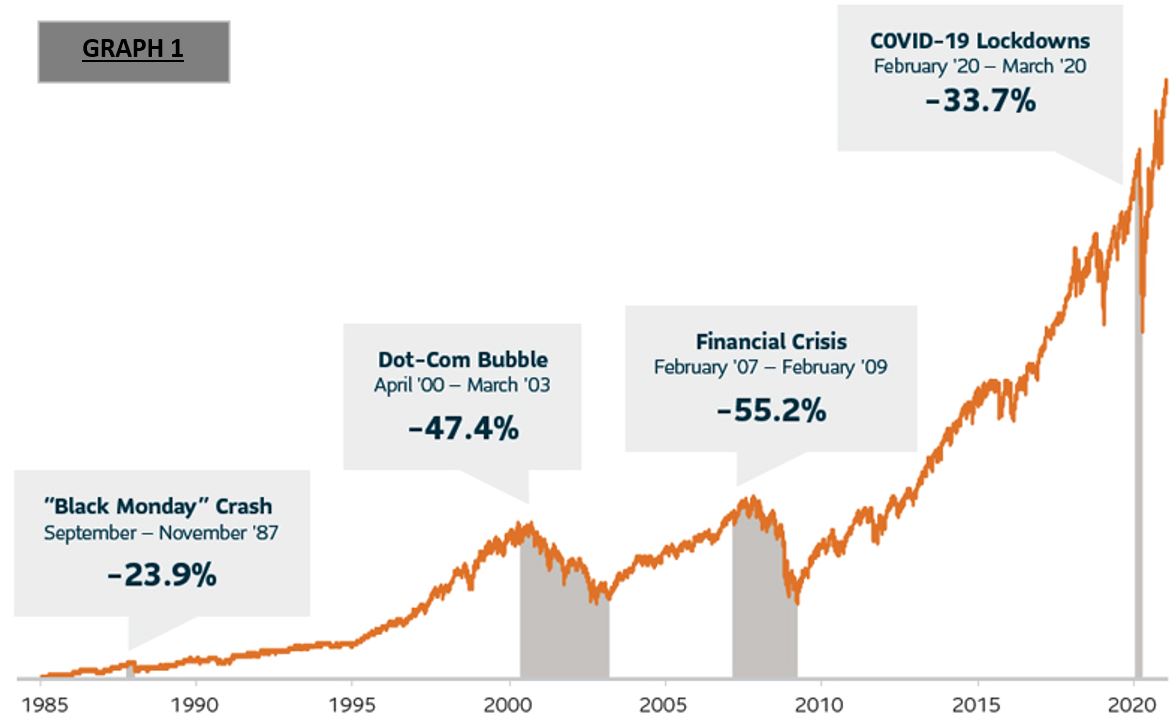

Fact 1: It’s not about “Timing the Markets”, but about “Time IN the Markets”. Time smooths out corrections and market crashes as evidenced in GRAPH 1.

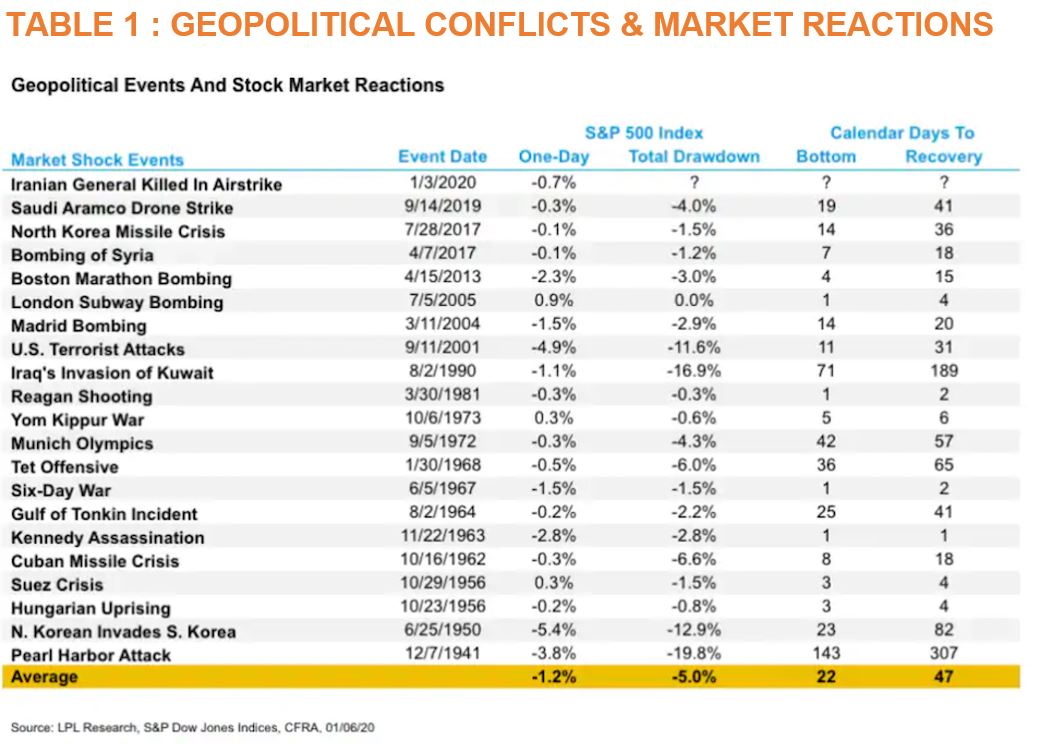

Fact 2: Markets recover even after a major conflict as shown in TABLE 1.

The Russian-Ukraine Conflict offers a window to invest…

When we launched “GlobalSave” - our AI-driven global diversified investment strategy in late 2019, little did we know then that after a few months, our machine learning AI algorithms would be battle-tested by the Covid-19 pandemic.

We shared the experience in our blog dated 9 March 2020 “Covid-19: Has Fear Run Ahead of Markets?” where we highlighted that the intense fear and the Feb 2020 Covid-19 market crash offered a good investment opportunity. It turned out to be right, as supported by past crises.

Invest when there is fear.

Like the Covid-19 and other past crises, the current Ukraine conflict is another window to define yourself as a shrewd investor when there is fear or a crowd investor when there is greed all around. Read our blog dated 30 March 2020 “Covid-19: A Chance to Define Your Investment Behaviour”.

Use AI-driven investment algorithms that work for you 24/7 without emotions…

Our GlobalSave separate managed investments applies machine learning techniques to the Nobel Prize winning Markowitz Modern Portfolio Theory with our proprietary parameters to seek the highest probable return for a given risk level chosen. It is not an “alpha” returns maximising system. GlobalSave is a dynamic asset allocation system that combines alpha and beta.

At PIVOT Wealth, our focus is not short term, but medium to longer term. Hence, we see this situation as an investment opportunity.

Conclusion

Stay invested to reap better returns…

Remember, the source of returns is volatility. All investments carry risks. At PIVOT Wealth, we use data and AI-driven methods to manage that risk through portfolio diversification. PIVOT Wealth helps you decide the risk you can tolerate, and once you decide, our global separate managed investment GlobalSave service focuses on finding a portfolio combination with higher probable returns for the risk you set.

Greed and fear drive human investment decisions…

As we watch the Russian-Ukraine conflict unfold, we need to recognize that fear currently dominates. Therefore, we see an opportunity for investing with potential returns in the next 9-12 months.

Be a Smart Investor…

Pick a one-to-three-year investment time horizon. Set the investment risk to match your risk tolerance. As the facts show, our GlobalSave separate managed investment portfolios which uses machine learning AI to invest has proven itself in 2021 by beating other competing digital investment platforms.

Contact us for a confidential presentation.

Regards

PIVOT Wealth Quantitative AI Investment Team

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. Carefully consider the suitability of any financial product or seek independent professional advice if unsure.